Correctional Facility Education

The Royal team provides ongoing financial education in multiple facilities. Since the start of this program in 2015, Royal has impacted over 1700 students.

The Royal team provides ongoing financial education at multiple correctional facilities. Topics covered include budgeting, dealing with debt, credit, and the true cost of life's expenses. Since the start of this program in 2015, Royal has impacted over 1700 students.

This program offers an opportunity to support a marginalized population. We believe it can play a small role in creating the systemic change that is required in our society.

Royal received a National Credit Union Foundation grant in 2019 and worked with representatives from the University of Wisconsin-Stout Applied Research Center (ARC) to create a survey to measure the effectiveness of the correctional facility program. Students showed statistically significant gains in content knowledge, as well as attitudes and confidence levels regarding financial literacy.

Program Partners:

- Barron County Jail

- Chippewa Falls Jail

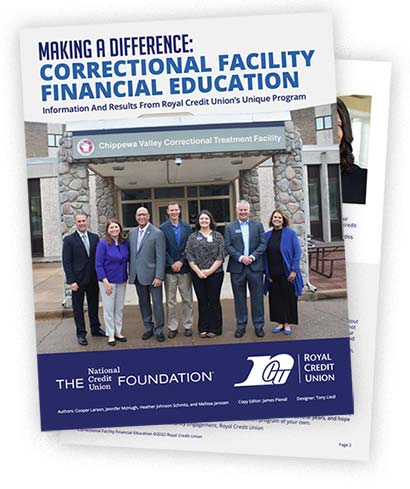

- Chippewa Valley Correctional Treatment Facility

- Dodge Correctional Institution

- Dunn County Jail

- Eau Claire County Jail

- Hennepin County Jail

- Jackson Correctional Institution

- Northwest Regional Juvenile Detention Center (Eau Claire)

- Polk County Jail

- St. Croix County Jail

- Stanley Prison

In February of 2022 Royal published a whitepaper to showcase our results in partnership with the National Credit Union Foundation, click here to read.

This program has two models to choose from:

Two Session Model

Lesson one: Wallet Wellness

- Budgeting with a SMART (Specific, Measurable, Attainable, Realistic and Timely) saving and spending plan

- Controlling your cash flow

- Tracking your spending

- Paying yourself first

- Learning your “money personality” and how it affects your financial decisions

Lesson two: What’s Your Credit Worth?

- Using credit wisely

- Requesting and understanding your credit report

- Addressing credit report errors

- Understanding credit scores

- Learning about predatory lenders

- Reviewing the pros and cons of credit cards

- Dealing with debt

Three Session Model

Lesson one: Wallet Wellness. The lessons modules are the same as in the two session model above

Lesson two: What’s Your Credit Worth? The lessons modules are the same as in the two session model above

Lesson three: The Cost Of Thriving

- Uncovering the true cost of purchases

- Planning meals and grocery costs

- Exploring renting vs buying

- Evaluating transportation needs

Correctional Facility Education Program in the news

Related Information

Money Donuts

Listen To Our Money Donuts® Podcast

Money and donuts - there's no more perfect pairing for a podcast

Articles

Check Out Our Full List Of Educational Articles

Get expert advice and information you can trust about a variety of financial topics

Financial Education

We're Ready To Help Everyone Learn More About Their Finances

It’s never too late to learn something new about finances, and we're here to provide all the help you need.