Save & Spend Duo

Get more perks when you bundle Duo Checking and Duo Savings accounts!

Call us at 800-341-9911 or visit an office

Save & Spend Features

- Duo Checking with Debit Roundup1 for automatic savings with every purchase

- Duo Savings earns a great rate on the first $10,0003

- No monthly fee when you make 20 debit purchases each month and use online or mobile banking4

- No minimum balance to open or maintain Duo accounts

- No direct deposit requirement

Duo Savings Balance Tier |

Savings Rate |

| On the first $10,000 | 2.00% APY2 |

| Amounts over $10,000 | 0.40% APY2 |

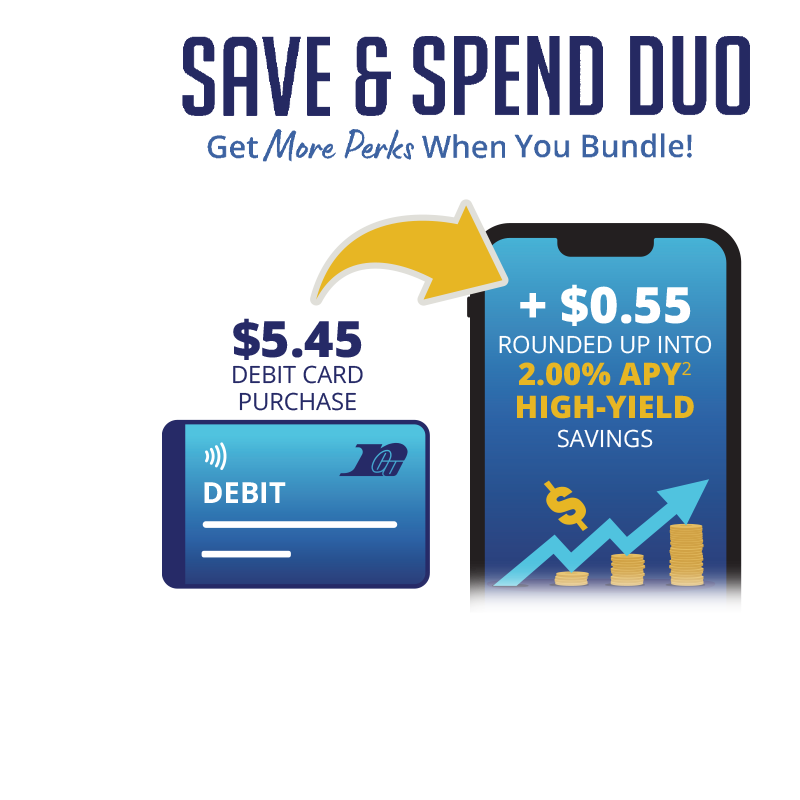

Debit Roundup

This feature is meant to help you reach your savings goals! Debit Roundup automatically rounds up debit purchases to the next whole dollar and deposits the roundup amount to Duo Savings at the end of each day to earn dividends.

- For example, a purchase for $4.70 is rounded to $5.00 and $0.30 is deposited to Duo Savings.

- Purchases made using your debit card, digital wallet, or debit card number are rounded up.

- Debit Roundup is enabled by default but can be turned off on request.

- If Debit Roundup would overdraw your account, the roundup is cancelled.

When are Debit Roundup funds transferred to a Save & Spend Duo Savings account?

Roundup transactions will occur at the end of each day. The roundup transaction will include the sum of the rounded up amounts for debit purchases that were posted to the enrolled account that day.

What types of debit transactions are eligible for the Debit Roundup feature?

To qualify, transactions must be a purchase, not an ATM withdrawal or a credit/return transaction. As long as transactions are purchases, both debit (or PIN) transactions and credit transactions are included in Debit Roundup. Transactions made using your debit card number online and via a digital wallet are also included in the Debit Roundup feature.

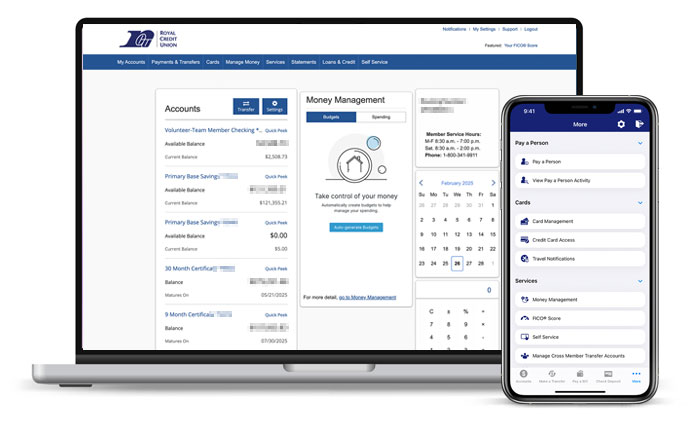

Take Control With Online & Mobile Banking

- Real-time alerts can notify you of low and high balances, deposits and withdrawals, and loan payment reminders.

- Card Management lets you freeze a lost or stolen card, order a replacement card, view card transactions, and more.

- Move money between your accounts, pay bills, or send funds to other people.

- Check your credit score for free.

- Deposit checks from anywhere with the mobile app.

- Enroll in paperless statements to enjoy faster statement delivery, enhanced security, and easier organization.

How To Get Started

There are two easy ways to apply for a Royal credit card!

Apply Online Now

Complete our easy online application and get a decision fast.

Visit An Office

Instead of applying online, schedule an appointment at an office to apply.

Need Help?

If you have questions or need help, call our lending team at 800-341-9911 or visit our contact page.

Insured by NCUA. No minimum balance required to open Duo accounts or earn APY. 1Debit Roundup rounds up physical debit card, digital wallet, or debit card number purchases to the next whole dollar and deposits the roundup amount to Duo Savings daily. 2APY = Annual Percentage Yield. Rates subject to change at any time without notice. 3The first $10,000.00 in the Duo Savings account will earn 2.00% APY; balances over $10,000.00 will earn 0.40% APY. APYs current as of 2/28/25; last changed 2/28/25. 4Fees could reduce balance and earnings. Duo Checking will incur a $5 monthly fee unless 20 debit purchases are posted to the account that calendar month and at least one account holder has logged in to online or mobile banking within the past 90 days.